As of September 2, 2025, Avalanche (AVAX) is trading at $23.88, reflecting a 0.38% increase from the previous close. The cryptocurrency has experienced an intraday high of $24.28 and a low of $22.72.

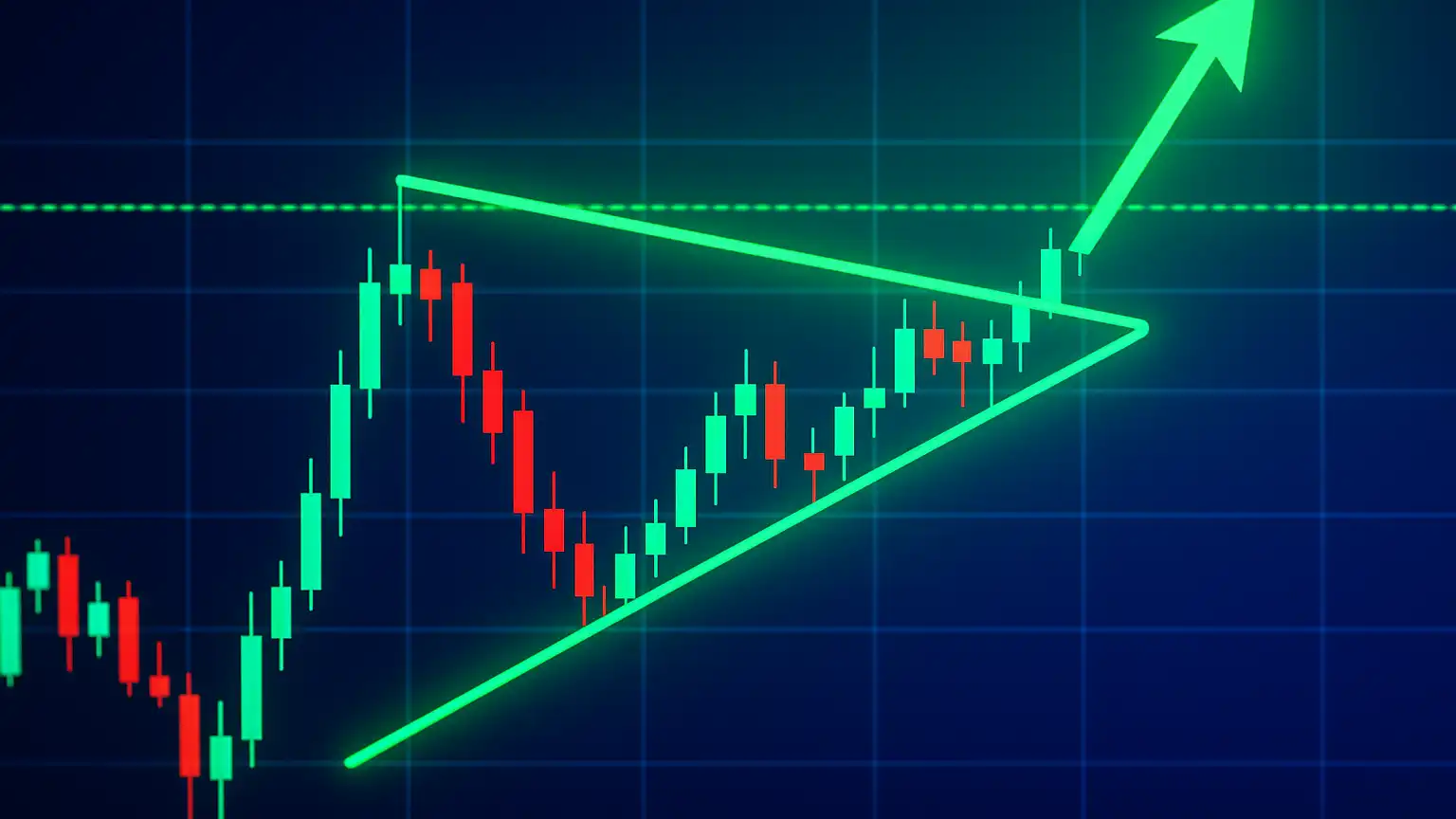

Technical Analysis: Symmetrical Triangle Formation

AVAX’s price chart reveals a bullish symmetrical triangle pattern, often indicative of potential upward breakouts. Currently, the price is near the triangle’s support level, suggesting that a breach of the resistance could lead to significant gains. The Relative Strength Index (RSI) stands at 52.3, signaling a bullish market sentiment.

DeFi Ecosystem: Total Value Locked Surpasses $1.9 Billion

Avalanche’s decentralized finance (DeFi) ecosystem has shown remarkable growth, with the Total Value Locked (TVL) reaching approximately $1.9 billion. This represents a 1.8% increase, highlighting sustained network activity and user engagement. Notably, the lending protocol Benqi leads with a TVL exceeding $1 billion, underscoring Avalanche’s strength in the DeFi sector.

Institutional Interest: VanEck’s ETF Filing

Institutional interest in Avalanche has intensified following VanEck’s registration of an Avalanche ETF in Delaware on March 10, 2025. This move signals growing confidence in AVAX’s potential and could pave the way for increased institutional investment upon approval.

Market Outlook: Potential for Further Gains

With the combination of bullish technical indicators, a thriving DeFi ecosystem, and rising institutional interest, AVAX is well-positioned for potential price appreciation. Investors should monitor these developments closely, as they may influence AVAX’s trajectory in the coming months.